What Matters to Employees

Businesses are collections of people. How can we understand a business without a view on its key people, company culture, and the company’s overall ability to attract and retain industry talent?

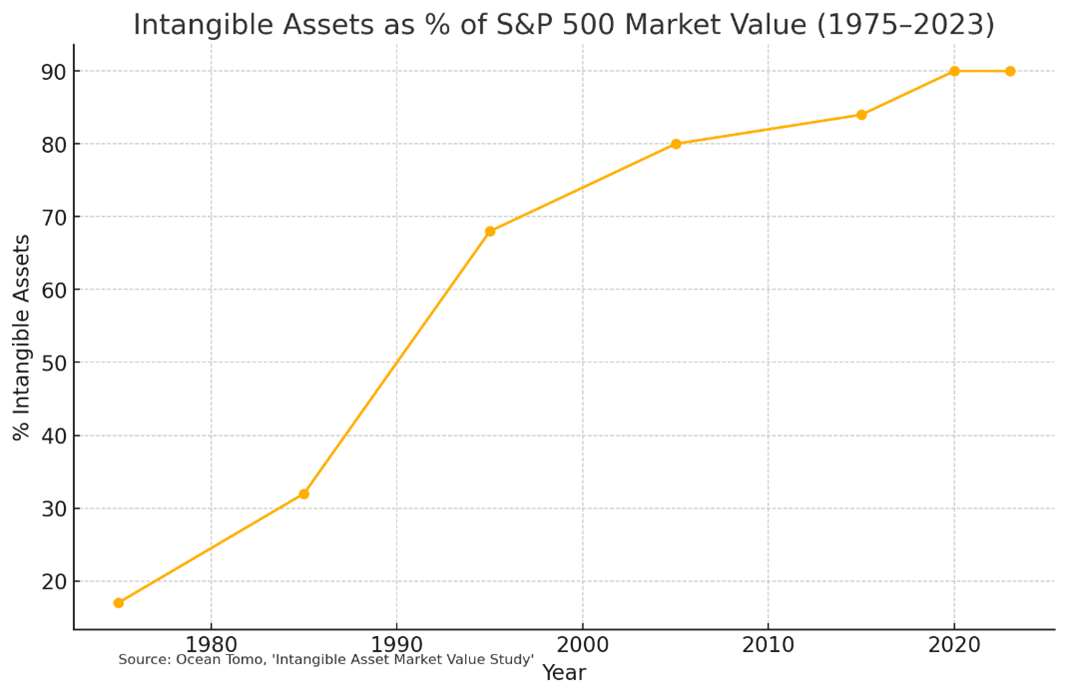

The substantial majority of the value of S&P 500 companies is allocated to “intangible assets” including talent (see: https://www.fordfoundation.org/work/learning/learning-reflections/better-understanding-the-value-of-human-capital/).

Most companies openly share that employees are their most important assets. Many businesses are acquired for substantial sums of money for the people and talent alone. We could probably answer many of our questions about a business by simply knowing whether current employees believe that the company’s best days are ahead of it rather than in the rearview mirror.

Yet too many publicly listed companies still do not disclose much data or provide analysis that could more easily allow investors to understand the company’s talent base and culture. The Ford Foundation has noted that only ~15% of public companies in the US disclose wage data, and a lower percentage report on worker retention and training initiatives. We love the way the Ford Foundation put it: Investors and others are “using a 20th-century lens to examine 21st-century enterprises.”

Attracting and retaining top notch talent over long periods is no easy feat. Talented people typically have options, and there has been a talent shortage for some time. According to a McKinsey study, 90% of organizations say they will have a meaningful skills gap in the coming years. Companies that can attract and retain talent at high levels in complex environments are simply in a better position to endure from an innovation perspective, which should be viewed as critical for customers, existing and potential employees, and investors alike.

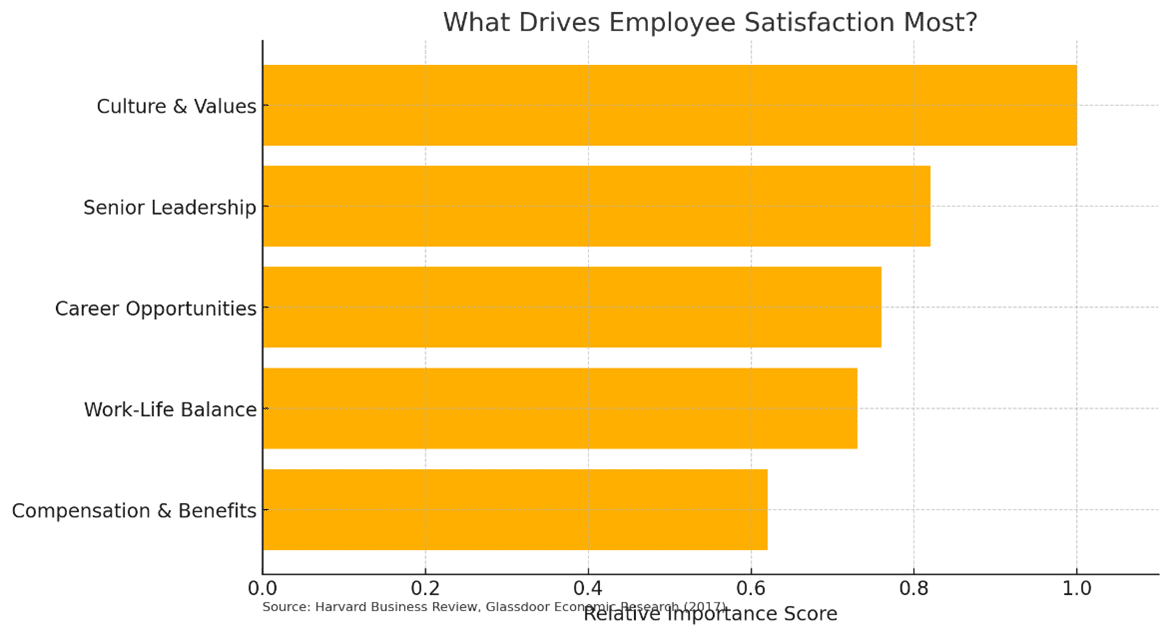

Studies and data show several factors that matter to talented people across industries. They include the culture and values of an organization, training and development opportunities, and compensation and benefits levels.

The most important employee-related issue we study qualitatively is the culture and values of the organization. A Harvard Business Review article from a Glassdoor economist highlights the importance of culture. It found that across all income levels, the top predictor of workplace satisfaction is not pay but rather the culture and values of the organization. The next highest predictor of workplace satisfaction was quality of senior leadership.

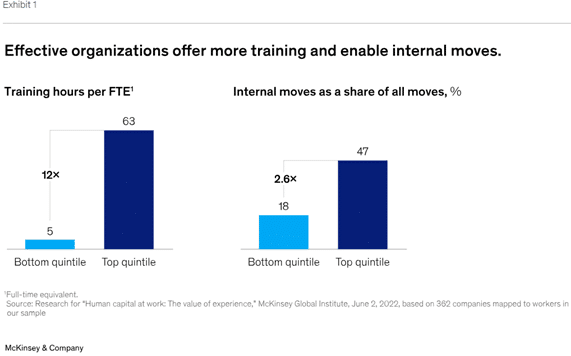

Training and development and career opportunities are important employee-related issues as well. As McKinsey states, “organizations that make learning and development a priority and part of their mission can create a virtuous cycle and improve the odds of success in attracting, advancing, and retaining talent.” Two data points McKinsey tracked were fostering a growth mindset through providing training and internal advancement opportunities.

As shown above, there can be a wide disparity among organizations in the amount of training provided (quality matters more but can be hard for a firm like McKinsey to measure) and the ability to move into new roles and responsibilities of interest within an organization. McKinsey has found that 40-60% of an employee’s human capital value which includes knowledge, attributes, skills and experience can be attributed to skills acquired through work experience. On-the-job training clearly matters. McKinsey also found that one of the top reasons employees cited for leaving prior jobs was a feeling that they did not have an ability to develop properly (41%).

Another key factor will always be employee perceptions regarding compensation and benefits levels and structures. Various studies show a direct link between higher pay and higher employee retention rates. For example, a Harvard study showed that a $1 per hour pay increase among warehouse workers resulted in a 2.8% increase in retention. Every $1 per hour loss in pay resulted in a 28% increase in turnover rates. Notably though, of six key workplace factors analyzed by Glassdoor, compensation was consistently rated among the least important factors of workplace happiness.

The Assessment

We seek cultures that prioritize highest performance, customer obsession, long-term thinking, accountability, and growth mindsets.

While more difficult than it should be, there are various ways to assess culture and talent. This can include information from traditional company filings that disclose the company’s product development expenses, which are mostly headcount-related today. We can also assess other business and competitor trends that might suggest the talent base is strong and that the company is viewed as attractive to potential new hires. We often hear from current and former employees through surveys and interviews, and we learn through simply following these businesses over multi-year time periods and continually tracking their evolutions. Metrics and information we can analyze for at least some good clues in these areas include a company’s financial strength, retention rates, net promoter scores, company initiatives relating to employee morale, and compensation practices. Given the importance of senior leadership quality for talented employees, we also spend considerable time on various governance-related issues.

There can sometimes be unconventional indicators that might give a better idea for the strength of a company’s employee base and culture. For example, how many talented people at the company who leave to pursue other opportunities eventually come back (boomerangs)? And have senior leaders shown a willingness to step aside when appropriate and make room for the next wave of deserving talent if doing so would be in the best interests of stakeholders?

The key is to triangulate multiple imperfect signals over time and treat them as part of a mosaic.

We believe investors cannot have a view on a company’s ability to endure for the customers it serves or the shareholders whose capital has been invested without a view on the company’s ability to attract and retain leading talent and establish a winning culture. There are several signals we consider in this area that cut across employee-related issues, financial strength, and governance. The goal is to identify companies that we believe (among other things) are best positioned to win their respective wars for industry talent over long periods.

Legal Disclaimer

The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS. This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by DENMARK Capital Management LLC. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner, and therefore, prospective investors should evaluate the Fund on their own merits.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the fund may differ materially from those reflected or contemplated in such forward-looking statements. DENMARK Capital Management LLC is the source for all graphs and charts, unless otherwise noted.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the fund and are presented solely for explanatory purposes.