When thinking about how to compound capital over time, and importantly how to enjoy our work along the way, our belief system as investors has pointed towards finding businesses that are objectively meeting customers and employees where they want to be. Put simply, businesses that are delivering what their customers and employees value. This can, in turn, allow businesses to become quite profitable. The ability for companies to have a “double bottom line” of delivering something their stakeholders value – and not just today but well into the future (the first bottom line) – and delivering financial strength and returns (the second bottom line) is part of our belief system.

Why Enduring Innovation Matters

It probably isn’t wise for an entrepreneur to start a business unless value can be added in a way that can’t be found elsewhere easily. This could be through offering a higher quality, more convenient, or more cost-effective product. If this vision exists and is executed well enough, then, definitionally, we now have something different from the status quo. We call this innovation. Innovation can range from groundbreaking to incremental. Either way, this type of business building is beautiful based on the ability of a person or group to provide something meaningful to others.

Innovation isn’t enough though. Innovation exists as of a moment in time. The Segway self-balancing personal transporter was innovative when it hit the scene. The Sony Walkman was innovative when it was released. MySpace was an innovative communications app for a period following its launch. This type of innovation can add value to others for a time. It can also pave the way for future innovation that might not have come next otherwise. But this type of innovation can also destroy a lot of value in terms of wasted consumer spending, lost jobs, and lost shareholder value. To become more, this innovation must endure. Innovation must be enduring innovation. Only a small percentage of products that are innovative at some point endure over decades. This is no easy feat. Enduring innovation is rare air.

To level up to enduring innovation, there generally needs to be a mix of ingredients that come together just right over many years. First, the founder(s) have an idea. Then, they might have some early investors that provide capital. Next, if the new product is delivering value that an initial group of customers appreciate, the business can start to generate revenue. This can provide more capital to invest to add talent and scale. The existing and added talent must further improve the early offerings over time. This can prevent others (we live in a competitive world) from providing similar or better value to the same types of customers. It might also be important to build new products as customer preferences evolve. The better the company’s vision and execution through these stages, the more revenue it can generate. More revenue can lead to more product development, selling and marketing, and talent investment.

By innovating over long periods, a company can deliver tremendous value to large groups of customers, employees, and investors alike – a triple win. This is how we frame enduring innovation. We believe enduring innovation is a powerful phenomenon that usually creates significant value for all involved.

Is Product Impact Something Different?

Product impact is important because a business’s entire purpose starts with developing a product that it believes can impact others. When “impact” is substituted for “innovation” – so product impact instead of product innovation –discussions can go a bit haywire. Discussions can become subjective rather than objective. They can become about personal values rather than the company’s stated purpose, vision and execution. They can get away from how consumers and employees view and engage with the business.

At their core, product impact discussions can devolve into whether the company’s products are solving a worthy enough societal problem, however that should be defined. The implication is that there can be innovative but not impactful products. One of our first principles is that people are generally smart and discerning. We believe people will eventually figure out if they are being duped or sold a bag of faulty goods. So, our first instinct was that this implication is generally false, but it is a worthwhile topic to explore.

We do, after all, invest in certain companies that present a strange riddle: How can over a billion people use your products regularly but say they don’t like them when surveyed?

With product impact or the notion of “doing good” from a product perspective, life has taught us that humans are complex creatures with different needs and wants. Different people can prioritize their needs and wants in different ways. For societies to function at the highest levels, the goal should be to maximize happiness and productivity for as many as possible. There are so many types of goods and services that can aid in this mission. It can feel like “Willy Wonka’s factory out here” with people choosing to engage with all sorts of offerings that they feel add value to them.

The factory cuts across all of the layers of Maslow’s Hierarchy of Needs below. We believe both innovation and product impact can be found in products that help us more easily satisfy basic human needs like improving access to shelter. We also believe innovation and product impact can be found in products that serve harder to quantify needs like self-esteem, the ability to express one’s individualism, providing motivation, or providing a sense of achievement.

The response we often get is, “Frankly, my dear, I don’t give a damn.” This is important stuff to flesh out as business analysts though. It directly connects to important questions we ask for every investment: Is there a strong value proposition, and can it endure?

Product impact can be subjective and requires judgment. We believe it is a slippery slope to become narrow with our views. Each of us is just one of billions on this planet. We have observed offerings across many industries that large groups of people and customers themselves believe deliver product impact for them.

For a small group of companies, there can be many millions or even billions of people who determine that the companies’ products are impactful for them over long periods. When this happens, customers, employees, and investors can win in ways nobody would put in a spreadsheet based on linear thinking. Our focus is pursuing these companies in an unconstrained manner.

Useful Product Impact Frameworks

Maslow’s Hierarchy of Needs is a psychology concept in the area of human motivation and personality theory. It describes a five-tier model. Basic needs are at the bottom. More abstract, growth-oriented needs are at the top. Some investors are considered “impact-first” investors. They might have the opinion that only companies serving the bottom two layers – like improving access to water, shelter, health, employment – can demonstrate product impact.

We believe all needs within all layers of the pyramid are valid and important to large groups of people even if some might be ranked higher than others by most.

Humans are complex. Some of us might feel we only need shelter, food, water, and employment. Others also want to pursue human connection, higher levels of self-esteem, and higher levels of expression and individualism. Why diminish some of the needs within this group? Why engage in debates about which our core needs are the most important and by how much?

We believe companies demonstrate product impact if they help people better realize any of these needs in a differentiated, innovative, long-lasting manner. This includes companies in the green layer whose products might promote self-esteem, achievement, or individualism.

This includes certain consumer discretionary companies like restaurant and retail businesses (Starbucks, Ferrari, Louis Vuitton, etc.). It is noble for certain investors to focus their time only on businesses serving the bottom two layers. But there is a broader set of needs that can unlock fulfillment, motivation and productivity for large groups of people.

Importantly, the “Self-Esteem” layer is typically misunderstood when thinking through product impact. The same can be true for products that serve the “Play” or entertainment dimension. Yes, we believe products that provide fun matter to many people.

A framework that highlights the complexities here was from (we believe) a Harvard Business School (HBS) paper by Ryan Daulton. It says product or service impact can be defined as “a change in the wellbeing of a stakeholder of a corporation as a result of the operations and/or decisions of that corporation.” But “wellbeing” is an extremely broad term. Is there a change in wellbeing if a consumer feels entertained for 60 more minutes per day due to the company’s products? Or is there only a change in the wellbeing if the company’s products improve a need at the bottom of the pyramid?

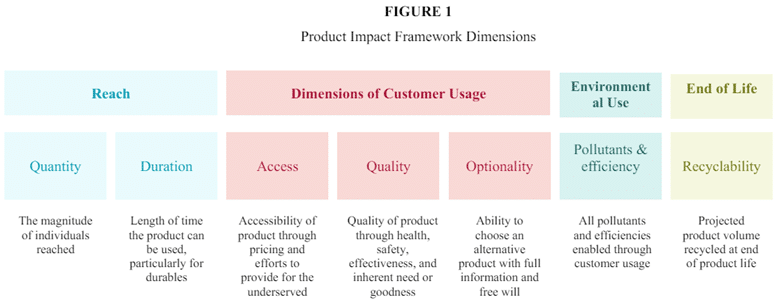

The figure below from a working paper from HBS by George Serafeim and Katie Trinh provides a useful product impact framework.

“Reach” is shown on the lefthand side above. It includes the quantity and duration of the reach of the product. These factors are indicators of product impact. If a product’s reach is widespread over a long period, there can be strong reach overall under this framework.

Then you get into the different product impact dimensions, or the different ways products can have impact. These are shown in the middle of this framework. These product impact dimensions include providing access, quality, and optionality. This starts to get into “wellbeing” again, but including “optionality” is important. It recognizes that the dimensions of product impact are broad. It supports the view that there are other real and important needs besides the basic ones including products that can further “free will,” which can involve extrinsic motivation, self-expression, etc. The idea is that if you could no longer do the things you want to do because you enjoy them, or you could no longer reward yourself the way you want to, it would be bad for your psyche and mental well-being.

Importantly, the “play” dimension is commonly dismissed. Often, products that consumers believe enrich play or fun are classified as unnecessary or “low impact.” But many people in this world would have major issues if there were limited opportunities to engage in activities that added fun, entertainment or otherwise provided relief from life’s everyday stresses. As a result, we believe companies operating within this play and fun dimension can be “high impact.” We have identified several investment ideas based on the market’s emotional reactions to certain of these companies.

We do not rank product impact sources because it is a slippery slope. We do not believe it is our job as just one or a few of billions to decide that people should only engage in activities that promote certain needs like love and connection or employment over other needs like self-esteem. Instead, we seek companies demonstrating innovation within any of the core areas of human need that we have identified to date.

Our Framework for Consistently Identifying Enduring Innovation

Terms like innovation and product impact can be subjective. The important thing is having thoughtful definitions and implementing a repeatable process for identifying what you look for. Identifying our definition of enduring innovation is at the center of our investment philosophy. To be an enduring innovator, our experience has shown that companies typically need a strong commitment to research and development, a track record of creating innovative products that drive leading engagement and market share, competitive advantages that can allow their innovation to endure over time, and an ability to reinvest cash flows into future innovation and growth at high returns. Finding the small universe of companies that are positioned to achieve this has been our focus over many years.

Is All Enduring Innovation Worth Investing In?

The last complicating factor is that not all enduring innovation is worth investing in. Shareholder returns are a function of how a company’s free cash flow per share progresses over time and how the market chooses to value this free cash flow per share post investment. What you pay is very important as an investor. Even the strongest enduring innovators under our approach might not make the cut for portfolio inclusion for valuation reasons. If we’re patient though, we typically find opportunities to invest eventually.

Legal Disclaimer

The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS. This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by DENMARK Capital Management LLC. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner, and therefore, prospective investors should evaluate the Fund on their own merits.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the fund may differ materially from those reflected or contemplated in such forward-looking statements. DENMARK Capital Management LLC is the source for all graphs and charts, unless otherwise noted.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the fund and are presented solely for explanatory purposes.