Our Strategy:

Denmark Capital's Enduring

Innovation Strategy

Enduring innovators, mispriced

Most innovation is fleeting. Enduring innovation is rare — it sustains for decades through strong customer engagement across industries. We aim to back these enduring innovators when they fall into what we believe are core mispricing setups due to structural, behavioral, or analytical gaps.

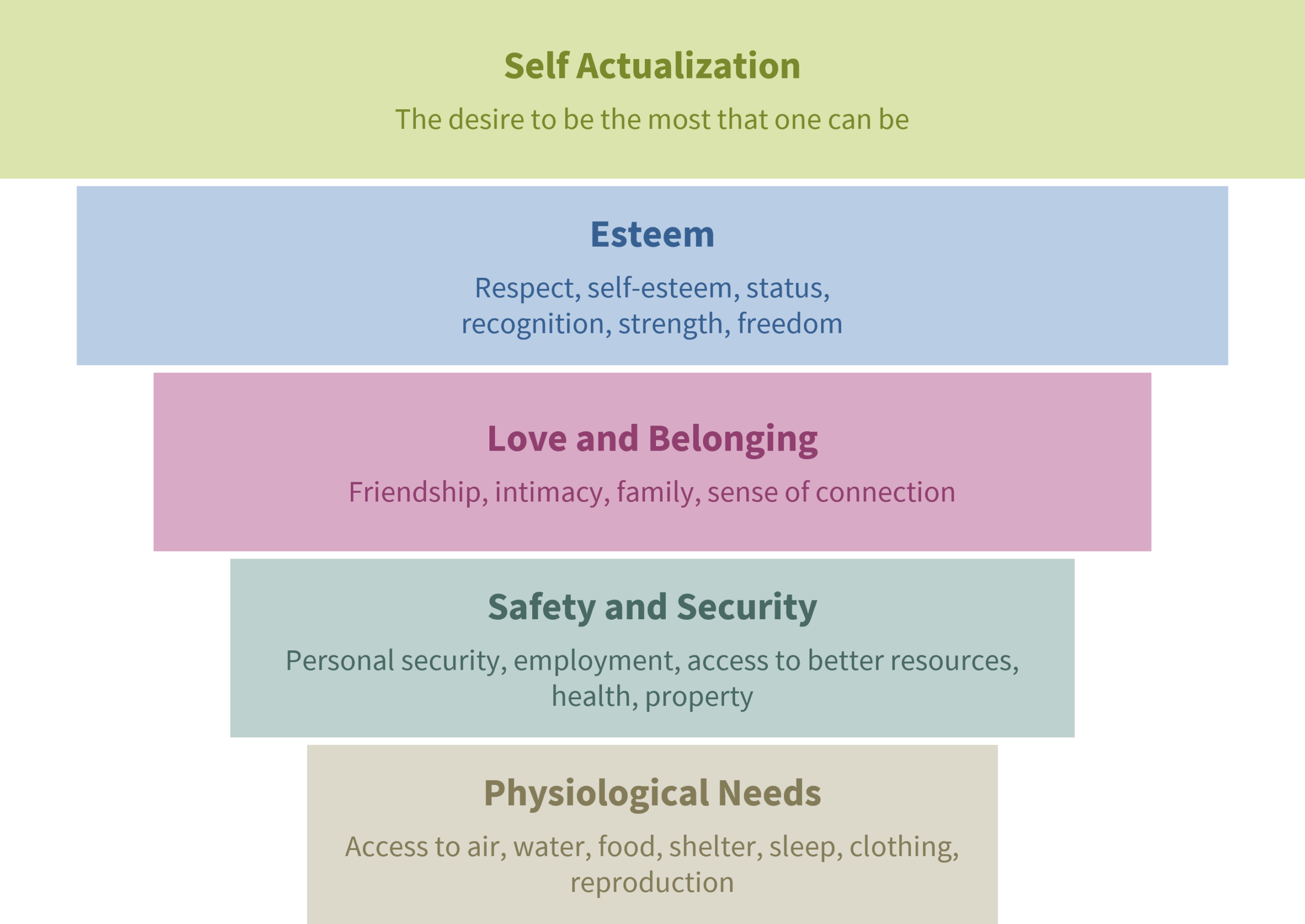

There are many categories of human need that enduring innovators can serve:

Sources of product impact for human needs include:

Provides

hope

Provides

access

Supports

values

Wellness

Saves time

and effort

Provides

information

Promotes achievement

and motivation

Therapeutic

value

Promotes creativity and individualism

Connects people

and businesses

Fun and

entertainment

Reduces risk

or cost

Areas where we might find enduring innovation include:

Artificial

intelligence

Consumer-facing

software

Enterprise / knowledge

worker-facing software

Software developer

tools

Semiconductor

technology

Financial services

access

Healthcare products

and services

Medical

technology

Media and entertainment content creation, distribution, and consumption

Advertising technology and measurement

Consumer products

and retail

Energy and power

infrastructure

Computing devices and infrastructure

Auto, aerospace

and defense

Robotics

Delivery and

logistics

2

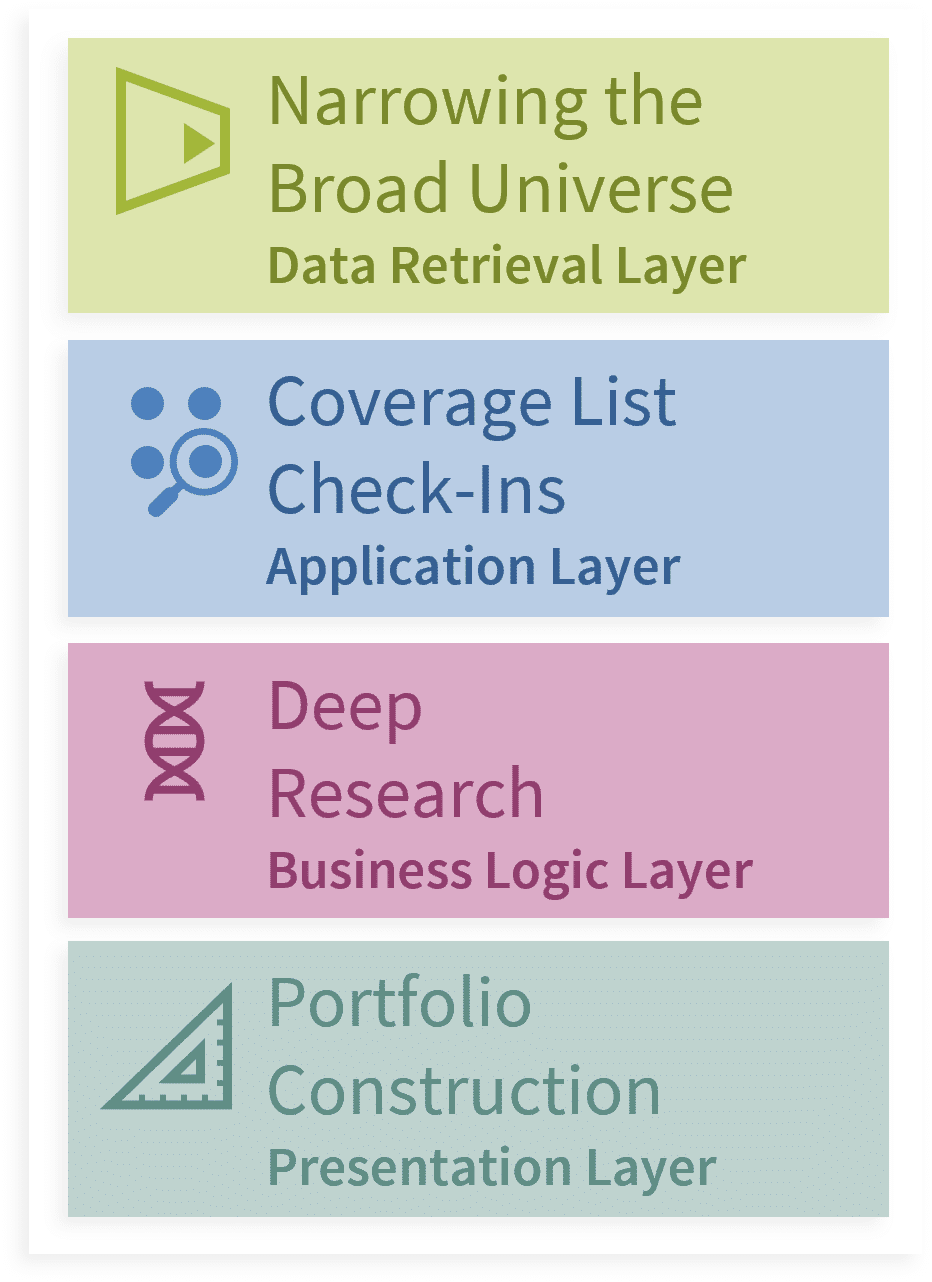

Surrounded by

process

Every investment passes through a proprietary framework and multiple “stops” to evaluate fundamentals, sizing, and risk.

Every investment passes through a proprietary framework and multiple “stops” to evaluate fundamentals, sizing, and risk.

We believe process elements designed to help quantify our qualitative views add focus and discipline to the portfolio construction process and provide a further check on decision-making consistency.

3

Structured to support an unconstrained approach

Our portfolio is built to let our best ideas matter with no artificial diversification or smoothing.

We are structured to hold positions in size when conviction, valuation, and risk align — in ways most public market investors structurally cannot.

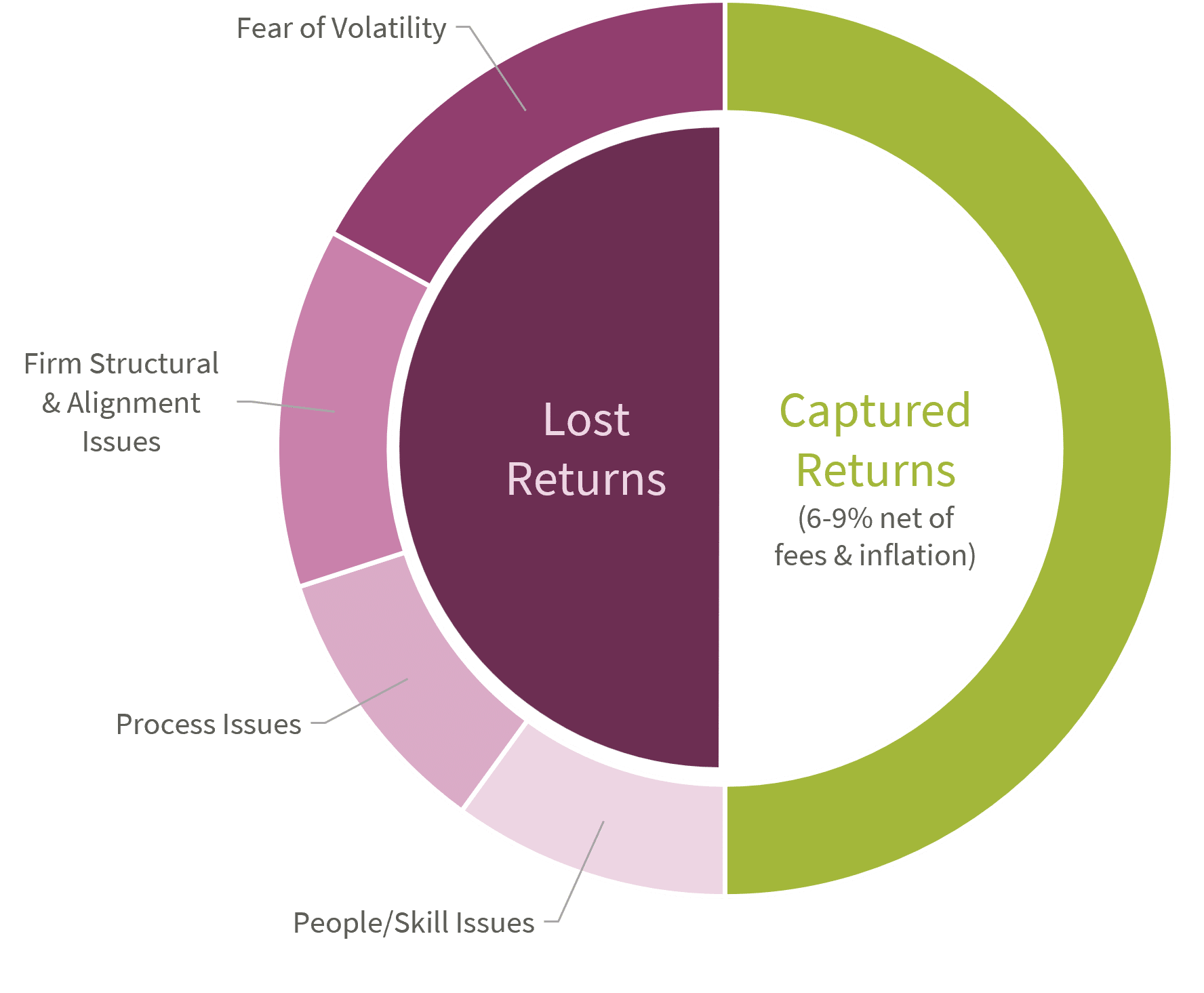

Why We Invest:

The Structural Opportunity

We are structured to:

| 1 |

Embrace volatilityWe are process-driven with risk management as the central focus but aim to take advantage of our portfolio construction flexibility and ability to embrace volatility with our leading ideas in an effort to be productive risk-takers. |

| 2 |

Address common firm structure issuesIncluding decision-making, team, and time allocation considerations. |

| 3 |

Avoid common firm alignment issuesIncluding firm size, fees, and client considerations. |

Typical return capture for active managers: