High-Conviction Investing.

Fully Aligned.

Our Focus

| 1 | We aim to back only next Fortune Global 100 companies – enduring innovators that are built to last |

| 2 | We find them in public markets and invest with conviction when we believe others misprice them |

| 3 | Our priority is being founder-led and fully aligned to follow our investment process purely and authentically |

Our Strategy

Our Strategy

Denmark Capital’s Enduring

Innovation Strategy

| 1 | Mispriced enduring innovators only |

| 2 | Surrounded by process – converging conviction and risk control is key |

| 3 | Structured to support a globally unconstrained approach |

Why We Invest

The Structural

Opportunity

We are structured to:

| 1 | Embrace volatility when appropriate |

| 2 | Address common firm structure issues |

| 3 | Avoid common firm alignment issues |

Our Difference

At DENMARK, we are specialists of a different type — carrying forward a deep understanding of world-class competitive advantage and durable growth. Our focus is enduring innovators, studied for over a decade, through a process designed to unitize risk-reward. With a globally unconstrained structure, we aim to deliver repeatable results.

At DENMARK, we are specialists of a different type — carrying forward a deep understanding of world-class competitive advantage and durable growth. Our focus is enduring innovators, studied for over a decade, through a process designed to unitize risk-reward. With a globally unconstrained structure, we aim to deliver repeatable results.

Meet Denmark Capital

Unconstrained public market investing in mispriced enduring innovators.

Latest Insights

Enduring Innovation and Product Impact

When thinking about how to compound capital over time, and importantly how to enjoy our work along the way, our belief system as investors has pointed towards finding businesses that are objectively meeting customers and employees where they want to be.

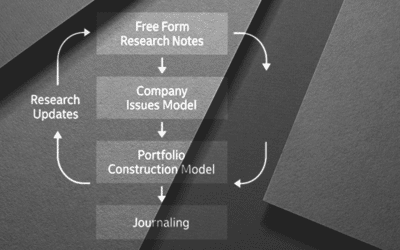

Investment Process Evolution

When we first started investing professionally, we never thought there could be so much room to evolve our investment process.

Sustainability

The definition of sustainability is, “Able to be maintained at a certain rate or level.” When we were first asked years ago if our portfolio companies were “sustainable,” we said, “Yes!” Then, we received feedback from clients and realized, “We’re gonna need a bigger boat!”

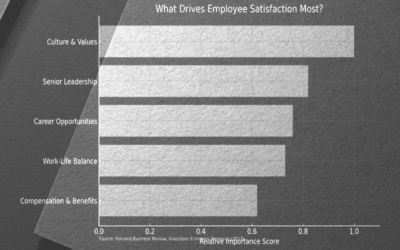

Employee and Talent Memo

Businesses are collections of people. How can we understand a business without a view on its key people, company culture, and the company’s overall ability to attract and retain industry talent?